Overview

The banking industry has been revolutionized in recent years in which the best online banks have taken the place of traditional physical banks.

All online banks have the same features as traditional banks, but with more ease, less fees, and inventive ideas. Unless you really like waiting in line to speak to a teller, this is the time to deposit your money in an online bank.

With lots of excellent online banks to choose from, it can be tough knowing out the best one for you. To help you in making your decision, I made a research and picked the 10 best online banks.

These online banks are exceptional for a wide range of reasons, including lesser fees, higher APYs, innovative ideas, quick and easy registration, and ease of use.

Here are the best online banks I researched and ranked:

- Best bank for hybrid banking: BBVA

- Best bank for children: Capital One

- Best bank for cashback: Discover

- Best bank for easy-access savings: American Express

- Best bank for automatic savings: Chime Bank

- Best bank for full service banking: Chase

- Best bank for cash management: SoFi Money

- Best bank for fee-free banking: CIT Bank

- Best bank for saving & budgeting: Empower

- Best bank for rewards checking: Radius Bank

1. American Express

This bank is an example of a major credit card company that also has an online banking service. In the case of Amex, it has one online banking product only: a high-interest savings account.

Despite the fact that American Express doesn’t offer checking, the high APYs plus the ease of access to funds make the savings account worthwhile. It also has a range of CDs; these will give you a higher APY in exchange for saving your money for a fixed period of time.

The initial thing to know about the American Express online savings account is that it comes with one of the best APYs in the industry, which is 0.50%. The next thing you should know is that it comes without any obligations—this means no fees and no minimum balance.

Additionally, it’s also worthy of note that it’s easy to make use of the Amex savings account. You can link your savings account with up to 3 other bank accounts and make up to 6 withdrawals each month—with your money available 24/7.

Pros

- 24/7 access to funds

- You can withdraw up to six times in a month

- It has free savings tools

Cons

- Does not provide checking accounts

- It is not linked to a debit card

2. BBVA

This is an excellent example of a hybrid online, mobile, and physical bank. BBVA is one of the 30 largest banks in America, which has branches in 7 states (Alabama, Arizona, California, Colorado, Florida, New Mexico, Texas) and a highly recommended online platform for residents of all 50 states.

It also has a highly acclaimed mobile app which is full of features, including personal finance tools to enable you manage your money and achieve savings goals.

Its customers pay the same low rates and have access to the same features as in-branch customers. The normal online checking account requires no fees.

The premium checking account, which gives you 0.01% interest and rewards from BBVA partners, also has no fees if you’re a student, or if you serve in the military, or if you meet the $4,000 minimum balance requirements.

To add to checking, this company also has a wide range of savings accounts, money market accounts, and certificate of deposits (CDs) accounts. Additionally, BBVA offers access to low-interest mortgages, loans, and credit cards.

Pros

- Does not take fees for students and military personnel

- It provides free withdrawals at 64,000 ATMs

- It has a full-feature mobile app

Cons

- It has branches in only 7 states

- Provides below-average APYs

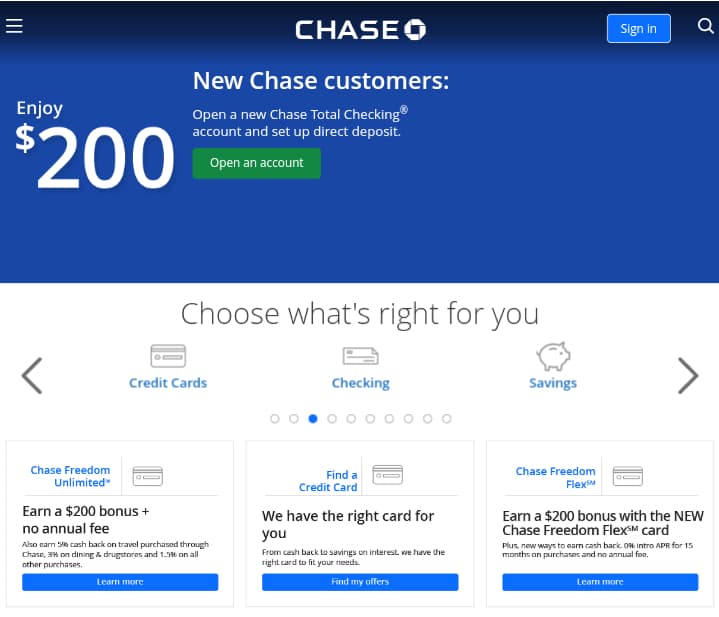

3. Chase

Though it’s mainly a physical bank, Chase is in this list because of its amazing online banking platform. Recognized as one of the “Big Four” banks, Chase offers its online customers access to a full set of banking products.

Examples include full-service checking accounts, savings accounts, CDs, and credit cards, as well as a range of loans, investing tools, and business banking tools.

This company lets you open a checking or savings account online, without going into a branch. Immediately you have an account, you can use it for stuff like paying bills, sending and receiving money (with either a mobile number or email address ), securely depositing checks, and automatically depositing paychecks.

If you want to do some transactions at a physical location, the great news is that Chase has an wide network of branches and ATMs around the country.

Pros

- Provides a full suite of banking products

- Allows you to send money by mobile or email

- Has a refer-a-friend bonus

Cons

- It provides low APYs on savings accounts

- Not strictly an online bank

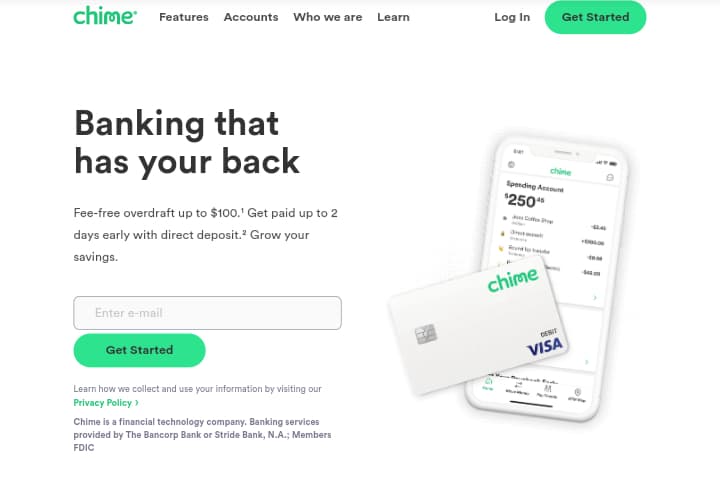

4. Chime Bank

This bank is an online/mobile banking service for the internet age. Get rid of all those traditional banking ideas like annual percentage yields and minimum balances.

Chime Bank has formulated a wonderful way of banking that involves a hybrid checking-savings account where you get paid for your spending activity.

This is how it works: when you open a Chime Spending Account, you get a free Debit Visa Card. This card gets linked to your account. Whenever you make an expenditure, it will automatically round up the amount and deposit the difference in your Savings Account.

For instance, if you get a coffee for $4.55, they will round it up to $5 and sends the extra 45 cents in your savings account. With this way, you grow your savings automatically—with no limits to how much you can save.

Pros

- It pays your salary early with direct deposit

- Provides a zero-fee overdraft (up to $100)

- Sends daily alerts and notifications

Cons

- It does not provide fixed savings

- Lacks many other features

5. SoFi Money

Of all the banks in my list, SoFi Money is most likely the most unique. As a mobile cash management account, it is built for people with smartphones; its website is very simple and is really only there to give you information.

As a cash management account, it has the same ease as a checking account, but with a significantly higher interest. A cash management account is really just a cool name for a brokerage account which helps you to manage your cash, make payments, and earn some interest.

What really differentiates SoFi Money from the rest is its rewards scheme. Whenever you spend, you receive cashback sent straight back into your account.

In addition, all SoFi Money customers automatically have access to exclusive customer benefits like events, experiences, career services, third-party discounts, and financial planning tools.

Finally, SoFi Money is part of the SoFi network of banking services, that includes home loans, personal loans, and student loan refinancing.

Note: SoFi Money is a cash management account, and not a bank account. They’re offered by a broker dealer. Neither SoFi nor its affiliates is a bank.

Pros

- It takes only 60 seconds to sign up

- Has a full-service mobile app

- Provides exclusive member benefits

Cons

- Not a traditional bank with checking and savings accounts

- It’s a new product

6. CIT Bank

CIT Bank is an digital bank that offers savings accounts, money market accounts, checking accounts and CDs. The bank is owned by CIT Group, a major financial services company.

As a native digital bank, CIT Bank makes very little overhead expenditure, enabling it to transfer savings to customers through zero fees and very generous APYs. CIT Bank’s maximum APY of 0.50% is one of the best savings rates out there.

With CIT Bank’s Premier Savings account, you can receive 0.45% APY that has no minimum requirements apart from a $100 minimum to open an account.

Pros

- It offers very high APYs

- Allows you to send money by mobile or email

- Has a wide range of CDs

Cons

- Does not have a 24 hour customer service

- It requires $100 minimum opening balance

7. Empower

As the name goes, Empower is a digital banking app that empowers its users to save money. This is achieved using 3 features: an Interest Checking account, Automatic Savings account and Cash Advance.

Empower basically offers you a financial expert in your pocket. The thing I admire most is their Cash Advance feature that gets you up to $250* direct to your bank account with basically no interest, no late fees and no credit checks.

Eligibility requirements also apply here. There is the lowest direct deposit to an Empower Checking Account, including other factors are important in order to qualify for instant delivery and advances greater than $50.

Pros

- You can receive up to $250 cash advance

- Helps you work toward savings goals

- It’s a 100% mobile platform

Cons

- Its app requires iOS 9.0+ or Android 5.1+

- Cannot be used on desktop

8. Discover

This company is best-known for its credit cards, which come with large cashback and low introductory rates. As it is, Discover also has an digital banking platform with a full range of account features with no monthly maintenance fees.

From checking to high-interest savings to CDs to debit cards with cashback, their digital banking platform has it all. Also, Discover has an innovative mobile app that allows you take a variety of actions, e.g. temporarily disable a lost debit card, find a no-fee ATM near you.

With its digital banking, you have the choice of opening a single account or creating a hybrid checking-savings account. The checking account also comes with a free debit card and 1% cashback on up to $3,000 in expenditure each month.

The savings account also comes with a fixed 0.50% APY (despite your balance), which is about 18x better than the national average. There is also a generous cash deposit and money market accounts on offer.

Pros

- It provides a 1% cashback on debit card purchases

- Has free tools to guide you to best account

- It has a user-friendly mobile app

Cons

- There’s no interest earned on checking

- It has only one physical branch location

9. Radius Bank

This bank is a full-service digital bank that is similar the big brick-and-mortar banks in products and is better than them (although slightly) on rates.

It gives you a choice of a checking account, a savings account, and certificates of deposit. It also has a variety of other banking products such as credit cards, personal loans, and student loans.

The APYs here are lesser than at other online banks, although that’s not the only reason to pick Radius Bank. The checking account comes with a debit card that gives you 1% cashback on most purchases.

This is in addition to the fact that Radius Bank covers all ATM fees around the globe. You can now understand why Radius deserves its place in my list of top 10 online banks.

Pros

- It provides a 1% cashback on most purchases

- Does not have ATM fees

- It does not charge monthly fees or balance requirements

Cons

- It has average APYs

- You must have a minimum of $25,000 for maximum APY

10. Capital One

This company has some online banking products such as high-yield savings accounts, checking accounts, and more. Its online savings and checking accounts all have no monthly fees and no minimum deposits which are required to open an account.

Capital One has excellent scores on consumer surveys, being fourth place overall in a J.D. Power study of U.S. Direct Banking Satisfaction in 2020.

Parents can equally open accounts for their children , giving them the chance to handle and learn more about money while an adult would be in charge of the account. Also, children can have a checking account with a debit card from as early as age eight at Capital One.

That’s such a wonderful young age to start managing an account (whether or not that’s too young is left for the parents to choose).

Pros

- No minimums to open an account

- It charges no monthly fees

- Checking accounts available for children

Cons

- Higher rates available at other online banks

Frequently Asked Questions

1. What is an online bank?

Basically, an online bank is a bank where you can control your account exclusively on your computer or mobile device.

Nowadays, most of the big traditional banks offer digital banking platforms. But online banks do that extra thing, stripping out physical branches altogether and enabling you to do all your banking online.

An exception to doing things online is still ATM withdrawals. Obviously, it’s impossible to make an ATM withdrawal without going to a physical terminal. But digital banks allow you withdraw money from ATMs. In fact, the top online banks give free withdrawals from tens of thousands of ATMs in their network.

2. How online banks work

When I say that online banks allow you do everything digitally, I really do mean everything. First, online banks lets you register online, without needing to go into a physical branch or speaking to a customer support representative on the phone. Then, once you’ve registered, you can perform all transactions from the comfort of your own home. This includes:

- Viewing balances

- Downloading statements

- Transferring money between accounts

- Opening new accounts

- Sending and receiving money

- Setting up automatic bill payments

- Depositing checks

- Applying for additional products, e.g. credit card, personal loan

3. Is online banking safe?

In theory, online banks are as safe as traditional banks. When it comes to securing your details, your bank has to do 2 essential things: secure your personal data; and insure your deposits with the Federal Deposit Insurance Corporation (FDIC) for up to $250,000.

The best digital banks use the following ways to protect your data:

- They employ the highest level of SSL technology to encrypt your data

- Constantly check your account and account activities for possible criminal activities

- Send you immediate notifications when suspicious activity is observed in your account

- Take you through a two-step verification process in order to log in to your account

- Some banks also provide ID theft protection as part of their package or as an add-on

4. What advantages does an online bank have?

Unless you really like to stand in line to talk to a bank teller, there is no great reason to stick with a traditional bank. Digital banks are better than traditional banks in virtually every way. They offer greater ease, lesser fees, and more features, while still having all the basic functions of regular physical banks.

These are the main 5 reasons to use an online bank:

Convenience: Digital banks allow you control everything from your computer or mobile device, with no need to ever walk into a physical branch.

Lesser fees: Due to fact that they don’t have physical branches, online banks have lesser overhead costs, and they usually transfer savings to customers in the form of lesser fees.

Better APYs and rewards schemes: Of course, because they have lesser overhead costs, online banks are better at offering better rates than traditional banks.

Unique features: The top digital banks have the best cutting-edge technology and innovative ideas, allowing them to offer unique features that traditional banks would never dream of.

24/7 account access: The days when you could only manage your account or access funds during opening hours are long gone. Thanks to digital banking, now you can bank 24/7, 365 days a year.

Summary

While banks can provide most or all of the services you want, it’s wise to also have an account open with a traditional bank. Traditional banks and credit unions also offer additional services like instant cashier’s checks, notary services, one-on-one support, and lots more.

Also, these traditional banks contribute to the community you live in. If you choose to go 100% online with your banking needs, you may have to wait sometimes for days to go through the mail, and should the website be unavailable, you may find yourself in a tight spot.