Overview

The life insurance industry is a huge one in the US. About $730 billion was spent by Americans in 2019 in getting new life insurance policies; that’s about 60% more than that on vehicle insurance. And while the best life insurance companies take care of more than half of the premiums, more Americans are now getting life insurance through Insurtech providers.

‘Insurtech’ is just the merging of ‘insurance’ and ‘technology’. Investopedia explains Insurtech as using technology to help people save efficiently through the traditional model in the industry.

Currently, the best life insurance companies all use Insurtech in various ways, and they can be split into three groups:

- The direct insurance carriers who offer life insurance policies

- The brokers work with the customers to help them get the best life insurance policy out there.

- The marketplaces also help the customer to get the best life insurance rates, but do not work as directly as the brokers.

This guide shows you my list of the best life insurance companies out there. I really wish this will help you get the best life insurance policy for you.

1. Policygenius

This company is a big player in the industry, and it deals with different types of insurance, life insurance included.

It has a technology that would scout for the best life insurance policy at the best rates for you. After that, an expert will discuss your options with you before handing you over to an insurance carrier.

Policygenius has a vast network of 20 insurance carriers, but it’s better if you apply through Policygenius than going directly to the carriers.

Pros

- You’ll get assistance from real insurance agents

- It has a best-price guarantee

- Customizable insurance types

Cons

- It’s not a direct insurance carrier

- It’s network only consists of around 20 carriers

2. Bestow

It offers the best term life insurance in the 21st century. In just a few seconds, you can get a quote and within a few minutes, you can complete your application. This is possible because of its proprietary insurance technology which has about $50 million of funds made by investors.

Bestow has all its policies issued by the North America Company for Life and Health Insurance. These policies are also reinsured by Munich RE, a top name in the business of life insurance.

Pros

- It takes only 5-10 minutes to apply

- There’s no medical examination needed

- Its policies are provided by A+ carrier

Cons

- It has no permanent life insurance

- No coverage over $1 million

3. Sproutt

This is a new company that makes use of AI to help you find the best life insurance policy out there.

There are 3 simple steps to take. One, you have to answer a few questions about yourself. After that, you’ll be shown a Quality of Life Index. The last step involves Sproutt presenting you with the best possible term life insurance policies for you and your family.

The Quality of Life Index (also the QL Index), according to Sproutt is an artificial intelligence tool that will assess your life and helps you live better. The main goal of the QL Index is to improve your health and help you with better life insurance rates.

Pros

- It has policies that are customized according to your lifestyle choices

- Provides personalized health and lifestyle assessment

- It provides a wide range of insurance types

Cons

- It’s relatively new in the industry

- Provides no weekend contact hours

4. HavenLife

This is a tech-driven insurance company that provides fast and easy-term life insurance coverage. Its policies are all written by the Massachusetts Mutual Life Insurance Company, a company with some of the best rates out there.

If you are a US citizen under the age of 60, you may apply for about $3 million in term life insurance coverage. Others may apply for $1 million.

HavenLife has two processing options, and with their technology, it will determine the best option for you. With InstantTerm, you can get up to $1 million in coverage if you’re up to 59.

This lets you skip the medical checkup and get full coverage instantly. Other applicants, however, are to take the medical checkup, and this takes about 20 minutes. After the checkup, you’ll get your coverage within 7–10 days.

Pros

- Its services are open to US and non-US citizens

- Most of its customers can skip the exam and purchase instantly

- It’s backed by MassMutual, an A++ rated insurer

Cons

- Has lower coverage limits for some users

- It can take up to 7-10 days for some users

5. National Family

This is an online marketplace for life insurance that links insurers with consumers. It has a vast network, including hundreds of carriers and agents who are there for you. This is a perfect starting point if you want to perform a quick market survey of life insurance providers without much stress.

Despite the fact that National Family Assurance has agents, it does not have the kind of customer service that the other brokers on this list have. But it is good because it gives you the chance to compare a lot of insurers before actually buying one.

Pros

- Has a network of hundreds of carriers and agents

- Provides excellent customer support from its own licensed agents

- It takes 1-2 minutes to see your credit results

Cons

- Its website lacks detailed information

- It also shares your contact details with third parties

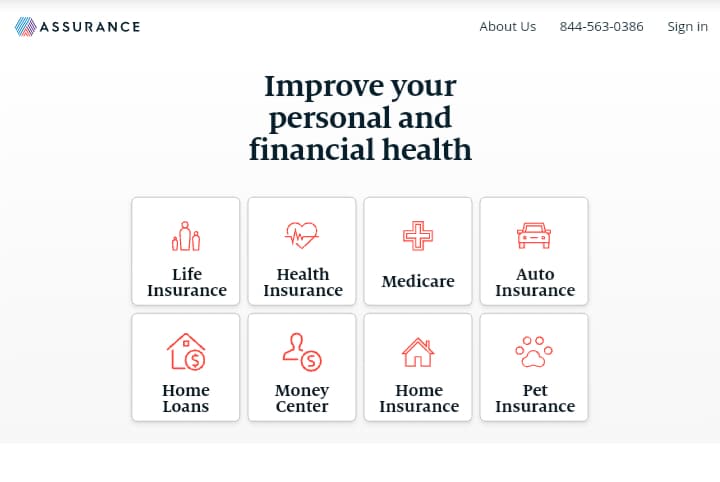

6. Assurance

This company specializes in many types of insurance, including life insurance, health insurance, and vehicle insurance. It is a good starting point if you want to compare life insurance providers.

It has a network of highly skilled agents who work with the top insurance companies. All you have to do is to fill out a request for a quote and you’ll get your best four results.

Assurance is an excellent starting point for people who want to do a comparison shop of life insurance companies. It has a vast network of hundreds of the best life insurance companies and agents. It takes only a few minutes to fill out a quote request form and get your best four results.

Pros

- It has a network of hundreds of carriers and agents

- The results appear in 1-2 minutes

- It allows you to compare health, auto and other types of insurance

Cons

- Its website lacks detailed information

- Shares your contact details with third parties

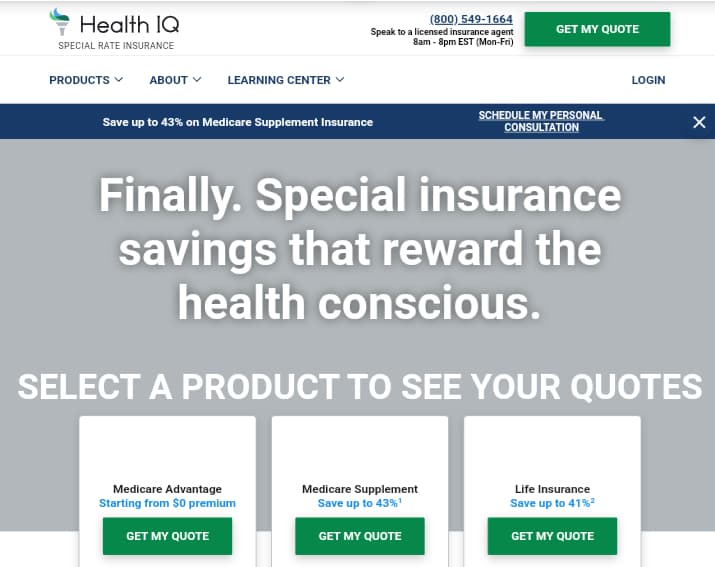

7. Health I.Q.

This is also a marketplace, but it is unique in the sense that it focuses on people with healthy lifestyles and wants to reward them by providing lower rates for insurance.

This is why Health I.Q. has a tough application process. You must have a high score in a medical history quiz and you may also present your medical records and plus other information proving that you’re in good health before qualifying.

However, if you qualify, you’ll get quotes from the best providers at very competitive rates.

Pros

- It provides amazing low rates for those in good health

- Has high-profile partners such as Prudential and Transamerica

- You can choose from a variety of plans

Cons

- To be eligible, you must have healthy habits

- It’s not a direct provider

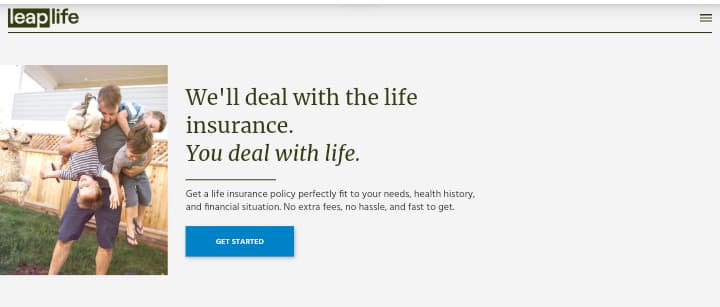

8. Leap Life

LeapLife gives people looking for insurance a simple and easy place where they can get quotes from the best providers in the market. The market will provide you with fast quotes which you can easily compare with others.

With an excellent rating from experts, and a huge network of carriers, it’s a good place to start. You can apply online and get instant approval to a selection of policies and terms. It also has an excellent customer service to help you with any issue you might have.

Pros

- You can compare, apply, and get approved online

- It’s fast and transparent

- Has a smart algorithm that provides highly relevant matches

Cons

- They do not provide live chat

- They’re only online and do not have a physical location

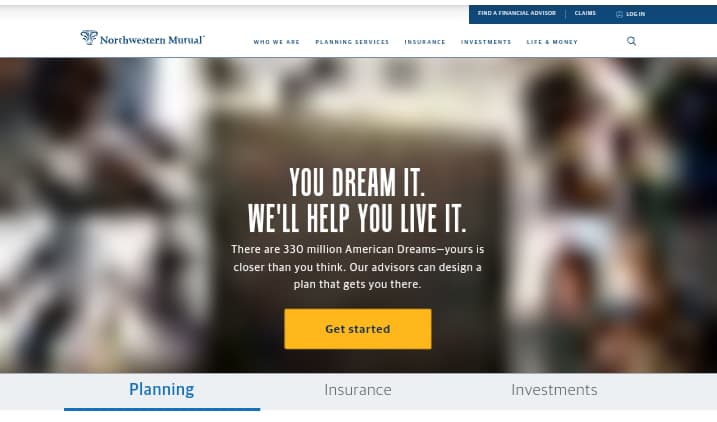

9. Northwestern Mutual

This is a company that has 160+ years of experience in the financial services market and also offers an old-school approach to life insurance.

Northwestern Mutual provides a wide range of coverage options and a low-tech rather personal method of knowing coverage needs. Its financial advisers are always available to assist customers through the insurance process.

Pros

- It offers a variety of coverage types.

- Can combine term and permanent policies.

- Some customers are eligible to receive dividends.

Cons

- The website doesn’t answer a lot of questions upfront.

- Company financial advisors need to begin the process.

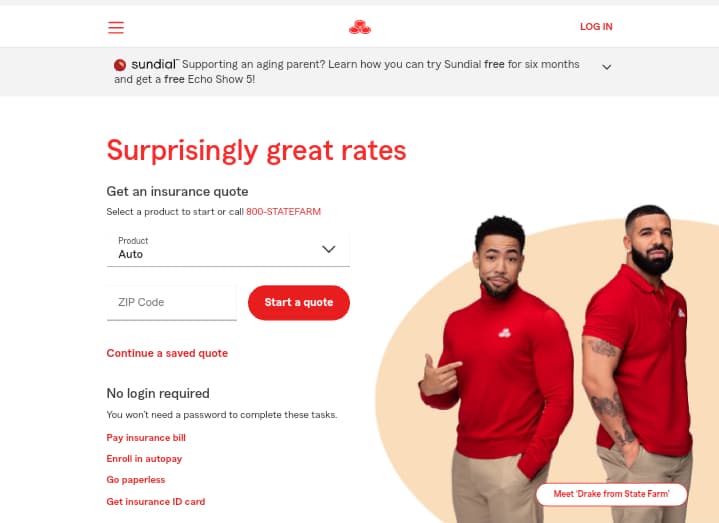

10. State Farm

State Farm has about 100 years of experience and provides a wide range of various types of insurance plus term, whole, and universal life insurance types. It also provides discounts for users who buy multiple insurance policies.

Pros

- A wide variety of policy types are available

- Most policies offer customization options

Cons

- The variety of options might be overwhelming for some

- State Farm is not available in all states

Frequently Asked Questions

1. How to choose the right life insurance

It’s necessary to really know what features to look for when reviewing and comparing the best life insurance companies before you purchase life insurance.

Life insurance is of different types, with each having a need it satisfies. Also, some providers have policies you can customize, which have added provisions. These are called “riders” and they can have extra benefits.

2. What life insurance companies offer

Life insurance policies are there to provide the beneficiaries, especially your loved ones with an amount of money in case you die. This also can be used in cases that require serious medical attention, or in cases where the person cannot provide for the family due to disability.

Different insurers have different processes for approving applications, but in general, they will consider health, lifestyle, and other factors before deciding on the right degree of coverage to offer. Life insurance is a wonderful way to make sure that your loved ones can maintain their standard of living even if you cannot be there to provide it for them.

3. Life insurance basics

It’s necessary to really know what features to look for when reviewing and comparing the best life insurance companies before you purchase life insurance. Life insurance is of different types, with each having a need it satisfies.

Also, some providers have policies you can customize, which have added provisions. These are called “riders” and they can have extra benefits. Although the majority of the applications are approved, the procedure for applying will help the insurer to know the amount of coverage and rates to offer.

4. What are the types of life insurance

Life insurance policies are of different policies, and each has its special benefits. These are some of the common options:

Term life insurance

It is not a permanent type of policy, however, it covers only a specific term. Insurance companies will give different terms, which can range from 5–30 years, but this kind of policy will provide coverage for only a specified period.

They are good if you’re searching for an affordable and simple alternative. Also, some companies can provide you with the opportunity to change it into whole life insurance when the original term expires.

Whole life insurance

This kind of policy is for an entire lifetime. It will provide benefits to the beneficiaries after the owner dies irrespective of when it occurs. These policies also appreciate value with time. Whole life policies also tend to have higher premiums which can be paid during your lifetime or during a set of defined terms.

These policies can also pay annual dividends that can be beneficial, but they’re really more expensive than the other options.

Universal life insurance

This is more like whole life insurance, but it gives you more flexibility because you can change premiums and even the death benefit. You can also make use of the cash that accrues over time from the policy and the premiums will be adjusted in accordance with the recent changes.

It is also more complicated than whole life insurance and the cash value that accrues over time is usually based on the investment strategy of the insurer. They’re excellent for those who want to maintain permanent coverage even when their income reduces during retirement.

Variable life insurance

This is also similar to the whole life insurance policy. But in its case, it sets a minimum death benefit with fixed premiums. One of its most important benefits is that you can improve the rate of cash value returns depending on your investment portfolio.

5. This is why you shouldn’t rely only on group or employer life insurance

Does your company provide life insurance? Then you can sign up for it. But don’t just stop there! Although many companies offer their workers a certain amount of insurance for free, but it’s usually not enough.

You can buy an additional insurance through the benefits of your company’s insurance, but you cannot take this insurance with you if you change your job, unless you can pay an expensive premium price to be able to take it with you. Therefore, if you want the best coverage, make sure you can take it with you even if you change your job.

6. How much life insurance coverage do I need?

Figuring out how much insurance coverage you need can be stressful, but you have to, first of all, analyze your financial situation and the possible expenses that will be made in the next 10–20 years.

If you’re deciding on how much coverage to buy, answer these questions:

- For how long do I need the coverage? For newly married couples that are starting a family, you need at least 20 years of coverage.

- How much premium can I afford? You have to strike a balance between purchasing enough coverage and having a monthly premium that suits your budget. The more coverage you buy, the more you will pay monthly.

- What things will my family need if I die today? If something happens to you today, there are bound to be lots of financial expenses that would land on your family’s shoulders.

The type of life insurance you finally go for depends on your current and future financial needs. But the most important thing is to have a life insurance plan.

7. How to check your insurer’s financial strength rating

It is good to know that your insurer is financially stable because if your insurer becomes bankrupt, there are limits to what the state can give you as compensation. Also, the state compensation will take a longer time to payout than the insurers themselves.

When searching for insurance you should also check the financial strength rating of your insurer which you can do on the websites of the four major credit rating agencies.

- A.M. Best. They’re dedicated to only rating companies in the insurance industry.

- Standard & Poor’s. This is a major credit rating agency in the US.

- Moody’s. Another top credit rating agency in the US.

- Fitch. This is the smallest agency here, but they’re good at what they do.

Regulation Information

Life insurance is directed according to each state across the United States. Most states don’t control these policies from the beginning when coverage first starts like they regularly do with vehicle or medical coverage.

This implies that normally applies to the claim period when recipients are granted the payout. Since the administrative climate fluctuates by state, it is important to know the local laws while applying for coverage.

Underwriting and Getting Approved

This is the process that life insurance companies and other financial institutions use to know how risky it is to offer potential policyholders their services. There are many formulas that are used to find out a person’s risk level.

In the case of life insurance, the formulas are health history, current health status, and other relevant information. This might appear to be an invasion of privacy, but these factors need to be checked to make sure that you get the best policy that suits your needs.

This process can take more than a few weeks to complete due to the amount of information needed and the time it takes to review them.

The First Step: The Application

Make sure to submit accurate information during the application process as it will greatly determine whether your request will be approved or not.

In this stage, the provider is mainly concerned with getting a policyholder, and at the same time, find out the details that will form the basis of the underwriting process.

Insurance companies make use of the application process to analyze basic information such as age, weight, height, and gender. This section also contains questions regarding your lifestyle and an overview of your medical history.

Medical Examination

This phase of the underwriting process might seem intimidating, however is typically quick, and in many cases, can be skipped entirely.

After submitting an application, most life insurance companies will request a quick paramedical checkup, which is normally free. This checkup commonly takes much less than an hour and is really a simple test to be sure that what is written in the application is correct.

This includes checking the blood pressure and pulse, checking the weight and height, and taking blood and urine samples.

This procedure should not take long, although in some cases, some insurers will ask you to supply a document recognized as an Attending Physician Statement, or APS. This will be needed if a provider feels they want more information, however is typically not required as it can be expensive and can be time-consuming.

The Review Process

When the above steps have been completed, the insurer will now review the things provided. Also, a life insurance company will check other public records to know their risk level. They will check records like motor vehicle reports and a MIB (Medical Information Bureau) report.

A Brief Interview

This stage involves an informal phone conversation with an insurer’s agent. This stage is not necessary and can be skipped. In the conversation, the agent will cross-check the answers you provided during the application. Always be truthful when you’re being asked certain questions about your lifestyle habits, as this will help with making sure your application is approved. This process only takes a few minutes.

Approval

When your application and all necessary documentation have been completely reviewed, a life coverage provider will continue to the approval stage. Unlike other financial services, life insurance policy approval is almost certain. Only about 4% of life insurance applicants get dismissed altogether.

In any case, approval is really not a basic yes or no answer, and all the relevant data conveyed during the application will be utilized to decide the premium, the amount of coverage, and other policy requirements.

Life insurance providers will, for the most part, give a rating for the approval based on the application plus some tables, including mortality, weight, and a “credit” table that can counterbalance negative elements with positive attributes like a healthy lifestyle. Approval ratings will commonly be inside one of these five groups:

- Approved Standard: This is the usual rating that people get, and it means that you can get standard rates and premiums as well as the initial quotes. This also means that the premiums will be locked in for the period of a policy’s term as you cannot change rates later.

- Approved Preferred Rates: This happens when your application tells the insurer that you have a healthy lifestyle and a less risky life. In addition to approving the policy, they may also offer a discount, which can get as high as 30%.

- Approved Substandard: This happens if your insurer decides that you live a risky life and may decide to offer approval at high rates. This might make the premiums to be as high as 500% of the average rate. This can be influenced by lifestyles such as smoking, bad eating habits, and other dangerous behaviors, but your rates can improve with time if your provider feels like your lifestyle has genuinely become better.

- Postponed: No, this doesn’t mean that your application was rejected. Rather, it means that the company found out a condition that may increase the risks in the future. Although this is not an immediate rejection, this may leave an applicant without insurance for a while as the insurance company might not review the application anytime soon. In this case, the best solution is to look for an alternative company.

- Rejected: This is a negative outcome, but it doesn’t mean that you can’t be insured. If you’re rejected, first of all, find out why they rejected your application. Also, you can request that this decision be reviewed and in some cases, it can be reversed. However, if the appeal doesn’t work, then you may try another insurance company.

Summary

Getting the correct life insurance policy can give you and your family significant serenity should your conditions get ugly.

As this is a significant choice that could influence the fate of your family, it’s essential to look at the very best life insurance companies out there and pick the one that best suits your needs.