Overview

Banks are widely known for charging ridiculous fees especially when you’re transferring money. This is why you should use the best money transfer services to send money abroad instead of banks. Money transfer services are a cheap and easy way to transfer money internationally, they’re also quicker and easier to understand than banks.

This article gives you my list of the best money transfer services in 2020. This list contains a variety of companies, from those offering the cheapest rates to those with the most currency or payment types. This is why online money transfer services are simply better in sending money internationally.

Bear in mind that any fee shown here is a rough guide. Your exact fee(s) will depend on amount being transferred, the mode of transfer and the receiver’s currency/country. The major currency pairs are cheaper while the others are more expensive. In general, online money transfer services are a lot cheaper than banks.

1. WorldRemit

This company will help you send money using a credit/debit card, bank transfer, Apple Pay or through other payment types. Your recipient can collect the money via cash delivery, cash pickup, mobile wallet delivery or airtime top-up.

Normally, money transfer can take about a week to get to the recipient’s account, but WorldRemit can speed up the process, making it possible for the recipient to get the money almost immediately. If you use the cash or mobile delivery options, your recipient can get the money that same day.

Pros

- It provides much more transfer methods than any other service

- Charge no fee on first 3 deliveries (but markup still applies)

- You can make transfers to more than 150 countries

Cons

- Major currencies do not have Mobile/cash options

- Their markups can be pretty expensive

2. XE

This company is popular because of its online currency converter platform. XE was merged with HiFX in 2019.

This new company offers a smooth and secure money transfer service. It offers transfers to about 60 currencies including the major and minor ones. It usually finishes your transaction on the same day you made the transfer.

All the transfers made are supported by an enterprise-grade security. Also, due to the fact that it’s XE, you can make use of all its amazing currency conversion tools without ever leaving their website.

Pros

- It provides market-beating rates for large transfers

- Has the best currency conversion tool in the market

- Provides enterprise-grade security

Cons

- It doesn’t provide credit/debit card payment for transfers

- Has fewer minor currencies than other services

3. HiFX

HiFX had been operating as its own money transfer service, but in 2019, it was merged with XE. Nowadays the two companies are basically one: HiFX still does manage the service, but they’re under the XE brand name.

This company is truly outstanding in the business. It offers transfers to around 60 currencies, covering all the main currencies as well as numerous exotics. It is speedy, secure, and gives you admittance to all XE’s great money exchange tools while never leaving the site.

Pros

- It provides market-beating rates for large transfers

- Has the best currency conversion tool on the market

- Provides enterprise-grade security

Cons

- It does not provide credit/debit card payment for transfers

- Has fewer minor currencies than other services

4. Ria

This is the a rival of WorldRemit in the business of online money transfer. And although it has restrictive transfer limits, it has lower fees, which makes it the cheapest way to send money internationally in cash.

Due to its partnership with PayWithMe, Ria provides the option of paying in cash from any 7-Eleven store. All you have to do is log into the Ria mobile app, select your closest 7-Eleven, book in your money transfer, and take the cash to the designated store within 24 hours.

Pros

- It has the fastest transfers of any provider

- The recipients can pick up cash or have it delivered to them

- It provides rewards for referring new customers

Cons

- It has low transfer limits ($2,999 per day, $7,999 per month)

- Some currencies are considerably more expensive than others

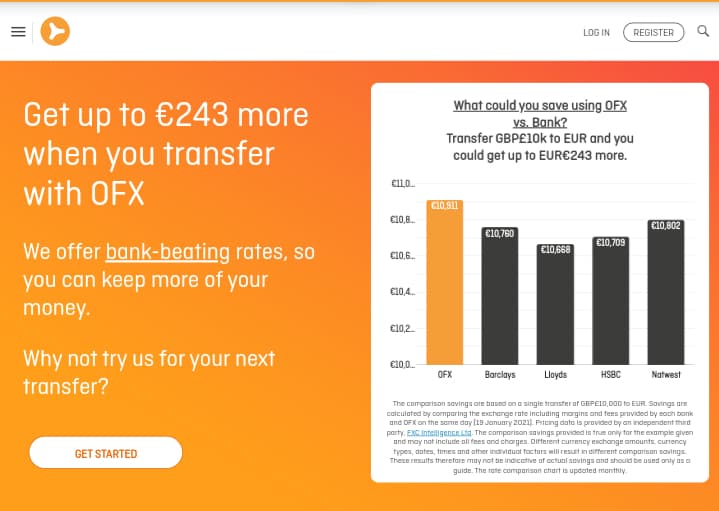

5. OFX

OFX was founded in 1998 and it’s an excellent money transfer service that allows you to send to most places in the world.

In fact, this company provides the opportunity for you to convert your money and send it to recipients in 55 currencies. They deal with the Brunei Dollar, Malagasy Ariary (Madascar), and Samoan Talar. Amazing!

It is a top money transfer service that lets you transfer money to most places in the world. With OFX, you can make a single money transfer of any amount, or you can set up recurring payments which they will handle for you.

Pros

- It provides transfers to 190+ countries in 55 currencies

- Has a user-friendly website and mobile app

- It provides tons of great tools, including forward contracts

Cons

- It does not provide you with rates without registration

- There is a lack of information about rates and fees

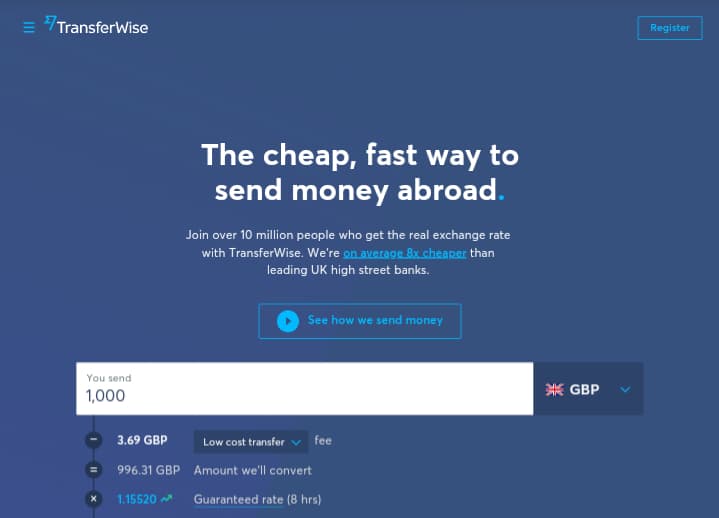

6. Wise

Wise, formerly TransferWise is a very safe money transfer service which lets you send US dollars to more than 50 currencies.

While other companies require you to sign up before you can see the exchange rate, Wise shows you everything immediately. Its website is very easy to use, and you can use a debit/credit/prepaid card or Apple Pay (from the Wise mobile app) to make transfers.

Its website is very easy and fast, giving you a full list of regulatory licenses, including extensive FAQs.

Another good quality of this company is the payment options available: although most of the top money transfer services only allow you to send the money, Wise allows you to use a debit/credit/prepaid card or Apple Pay (from the TransferWise mobile app) to make payments.

Pros

- It will show you how much you’ll pay upfront

- You can pay by bank transfer, debit/credit card, or Apple Pay

- Can also track your transfer status on website or mobile app

Cons

- It does not provide a cash-deposit option

- Some of the currency pairs are very expensive

7. CurrenyTransfer

This is a marketplace that links you with the best exchange rates from its network of money transfer services. It’s not a direct money transfer service, but this isn’t noticeable as it handles the entire process for you.

This service is very secure and once you’re done with your registration and you get approved, you can start making transfers immediately.

Pros

- It will find the best deal for you from its vast network

- Handles the entire transaction

- Provides hands-on customer support

Cons

- Provides fewer currencies than other services

- It’s not suited for small transfers

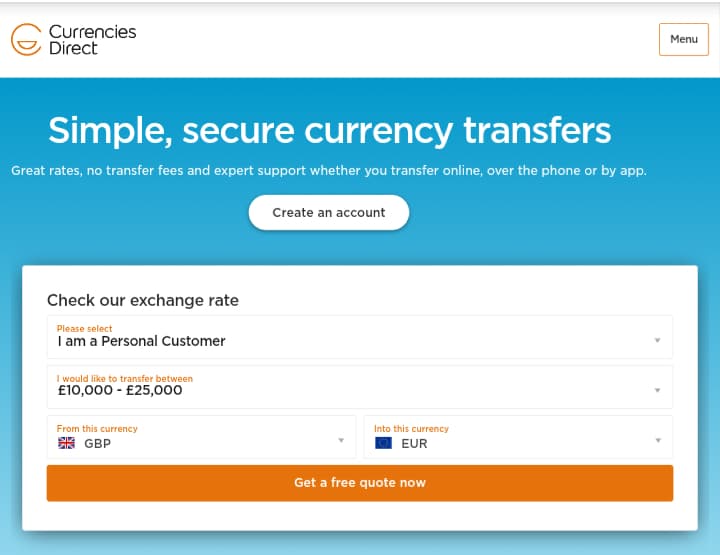

8. Currencies Direct

With 24 years of experience, Currencies Direct is one of the most trusted money transfer services in the world. It offers transfers to more countries than any other company. You can also use this service for many reasons like sending regular funds to relatives abroad or making one-time payments to someone abroad.

Although you have to register to be able to view the rates and fees for your chosen currency pair(s), once you’re registered, you’ll get a range of great features. For instance, you can create rate alerts, purchase currency in advance, and decide to receive a newsletter with daily currency updates.

This company also has a user-friendly website plus a highly rated iOS/Android-compatible mobile app.

Pros

- You can make transfers to 200+ countries in 40+ currencies

- It has an excellent (4.8/5) Trustpilot rating

- Provides excellent solution for individuals and businesses

Cons

- You’ll see no rates without creating an account

- There is a lack of transparency about rates and fees

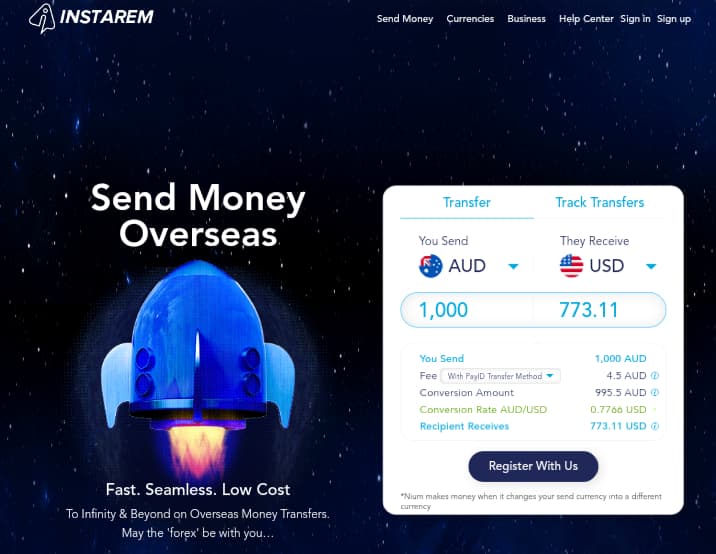

9. InstaRem

This is an online money transfer service that has its focus on on remittances. It is particularly great for transfers to countries like Vietnam, India and the Philippines, and other regions in Asia, Africa and South America.

InstaRem boasts of being able to quickly and conveniently transfer money.

Pros

- It has an easy-to-use website

- Provides competitive rates

- It does not have a minimum amount you can transfer

- 24/7 support available in over 20 countries around the world

- You can get an accurate rate for your transfer using its online calculator

Cons

- Most currencies have maximum transfer sizes

- It does not provide foreign currency accounts or digital wallets

- Does not have a fixed transfer fee

- Most transfer methods are not available in all countries

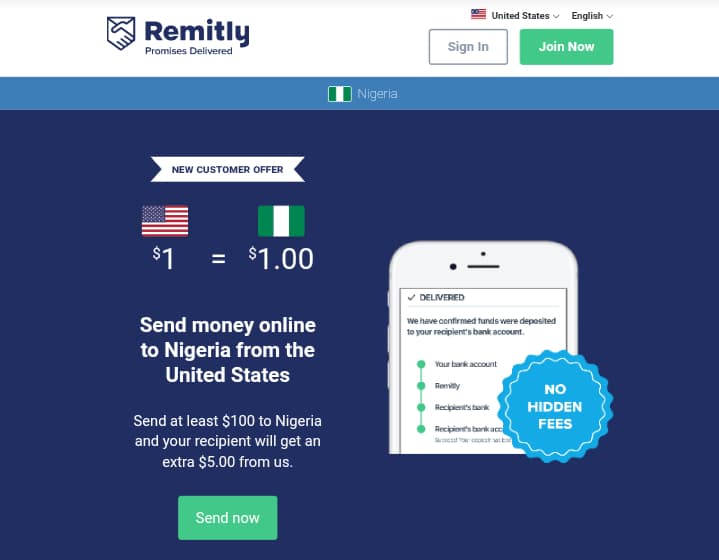

10. Remitly

Remitly allows money transfers from over 17 countries to more than 50 recipient countries around the globe. It boasts of over 140,000 agent locations. This makes cash pickups easier for speedy transfers.

This company is one of the most trusted services in the money transfer industry and it popular for its competitive fees and user-friendly mobile app. It provides a wide variety of payment options, such as bank deposit, cash pickup and also home delivery. It also has an overall score of 4.5/5 on Trustpilot.

Pros

- Recipients can collect money from any of the partnering banks

- Provides different payout options

- Exchange rates can be locked when you place an order

Cons

- Some payment methods have high fees

- It has low daily limits

Frequently Asked Questions

1. What is the best way to transfer money?

In contrast to banks, money transfer services offer various methods of sending and receiving money. Money transfer services are the most ideal way to send money between banks, as they charge less than the banks themselves.

Another advantage of money transfer services is that they offer numerous methods of sending and receiving money.

Some of the ways money transfer services lets you pay for transfers include:

- Bank transfer

- Debit/credit card

- Apple Pay

- Cash (in participating third-party stores)

Also these are some of the means for receiving money transfers:

- Direct to bank account

- Cash pickup

- Cash delivery

- Mobile wallet

- Mobile recharge

2. How to find the best money transfer company

Getting the best international money transfer service implies that you have to perform some research.

Reading impartial reviews is the initial step as doing that can help you sieve out the fakes from the authentic companies.

On the off chance that you’ve read the reviews and are confused between a couple of highly rated companies, you would then be able to zero in on what’s essential to you:

Rates and fees? If this is the central factor, you can utilize fee estimating tools to see which company will offer you the best rates for your transfer needs.

Security? Pick an service that is known for its security highlights and one that you can trust.

Fast transfers? If you’re concerned about the speed of the transaction, pick the service that offers the quickest transfers.

In the event that one company offers better rates and another offers quicker transfers, you can utilize every one to suit your requirements for every specific money transfer. Because you’re using one service doesn’t mean you can’t change to another one or make use of two at the same time.

Keep in mind, you’re paying for the service, so you have the right to take advantage of it.

3. What’s the cheapest means of sending money?

Money transfers contain 2 sorts of expenses: a flat fee, typically around $1 to $5, and a markup (otherwise called margin or spread) of 0.3% to 5% of the total amount transferred. A few organizations have quit charging the flat fee and now make money completely from the markup.

The specific markup is dictated by the amount transferred, means of transfer and beneficiary’s country/currency. When sending from USD to major currencies like euros, pounds or Canadian dollars, you can hope to pay a markup of under 1%. When transferring to exotic and minor currencies, you can hope to pay more.

As a result of the variety in markups, it’s important to compare a couple of providers before making a transfer.

To start with, choose which currency pair to transfer, how regularly you intend to move the currency pair, and the amount you intend to move each time. At that point, request for a quote for your picked pair/amount from a couple of the providers above.

Summary

All the companies in my list have strong reputations in the industry and provide a range of services to their customers which make money transfers easier and more cost-effective.

It’s always necessary to remember, however, that the best service for one kind of transfer might not be the best for another kind.

However, if you want a stress-free and low-cost way to send money abroad, then go for Wise. But if you want a fee free money transfer service, then OFX is the best option. Finally, if you want an instant way to transfer money especially to Asian and African countries, InstaRem is the perfect choice.