Introduction

Regardless of whether you have been handling invoicing for a long time or you do not have experience in taking care of such things, the best invoicing tools will ultimately change the way you run your business. At the basic level, these applications create and send an invoice for the products or services you have provided to your customers.

But the best invoicing tools have more uses. They allow you to create online invoices, giving you an easier way of sending invoices to your customer. They also facilitate a more efficient invoicing so you can get your money faster and are loaded with lots of features that all sum up to a more professional, seamless, and efficient system of billing.

Therefore, it is not surprising that most companies choose to abandon this task to modern technology. After all, if an application can make your job faster, easier and better, why not leave it to the app and focus on other important things? Using the best invoicing tools, you can simultaneously send out multiple invoices, quickly follow up those customers who haven’t paid yet, and present yourself as more professional to your customers.

Also, they allow you to improve the accuracy, cash flow, and effectiveness of your overall business operations. And at the end of the day, the best invoicing tools ensure that you get paid faster and more consistently too.

1. Quickbooks

Professional accounting software with all features

QuickBooks is definitely one of the best invoicing tools in the industry. Developed and released by Intuit, QuickBooks is an efficient accounting, payroll, and bookkeeping application that includes beautifully simplified invoices in a great package. And there’s a good reason why QuickBooks continues to lead the charts despite the industry’s tough competition.

First, companies can accept all types of payments, including credit cards, debit cards, and ACH bank transfers, directly from their online account. Therefore, you get paid faster.

QuickBooks is totally customizable, including logos, colors, and more. This way, the customer knows that it’s you. QuickBooks invoicing tool gives you great features such as regular sending your customers recurring invoices, Google Calendar, TS Sheets, or a personalized QuickBooks time tracking, plus an auto-matching tool that pairs the payments with the invoices. This way, your books are always up to date.

Pros

- Instant payment notifications

- Automatic payment matching

- Accept online payments

Cons

- More expensive than the competition

- Some tasks are not intuitive

Pricing

- $12.50-$75 per month

Free trial

- 30 days

2. FreshBooks

Ideal small and medium-sized business’ solution for going pro

FreshBooks is one of the best invoicing tools that make it easy for businesses of all sizes to manage their finances. It also helps you to create invoices online easily.

FreshBooks has a new mobile app that lets you handle your invoice account remotely. The invoice application has many useful features, such as cost sorting, deadline setting, and late billing setting. FreshBooks has a clean dashboard, and the entire user interface is intuitive and straightforward so that anyone can manage it.

FreshBooks comes with other useful features, one of the best features being tracking of expenses. You can track individual expenses and link them to specific customer invoices. Therefore, all aspects of your work will be adequately and efficiently billed.

FreshBooks also allows businesses to collect online payments using credit card payments, PayPal, or Google Checkout. This is a new feature not found in many other invoice software options and is very useful for customers and businesses. Along with excellent reporting capabilities, FreshBooks is a clear choice for efficient and professional business invoice management.

Pros

- Good team collaboration and user interface

- Easy online payments

- Expense tracking

Cons

- Bulk invoice creation is confusing

- Some bugs have not been worked out

Pricing

- From $4.50 per month

Free trial

- 30 days

3. NetSuite

Supports complex subscription models

Oracle NetSuite is an all-in-one business management suite that includes many tools in areas such as accounting, human resources, customer service, and e-commerce. Its billing tool, SuiteBilling, helps businesses manage their billing process with an emphasis on managing complex subscription models.

SuiteBilling can be used as a standalone product. However, the high licensing fees and cumbersome setup procedures mean that it is best used along with other NetSuite tools like Payroll, HR, budgeting, and forecasting, making it one of the best invoicing tools available.

Pros

- Supports multiple billing models

- Enables customer-specific subscriptions

- Enables automated changes to subscriptions

Cons

- Too expensive to use only for invoicing

- Real-time reporting deemed weak by customers

Pricing

- It starts from $99 per user per month

Free trial

- 14-day free trial

4. Tipalti

Automatic invoice processing thanks to OCR

Tipalti is one of the best invoicing tools for the automatic receipt of invoices from suppliers and payments for companies with large receivables workflows.

Available in two subscription levels, you can automatically manage end-to-end account collection and payment processing.

Pros

- OCR detection for received invoices

- End to end payment technology

- Can handle payouts in 120 currencies

Cons

- Not suitable for small businesses

- Some ERP integrations still missing

Pricing

- $299/month (Tipalti Express)

- $447/month (Tipalti Pro)

Free trial

- Free demo

5. Invoice2go

Invoicing for on-the-go professionals

Invoice2go can help you create attractive invoices from your mobile phone. Therefore, it is a good choice for contractors, painters, electricians, and anyone else who does not usually use a laptop for work.

While this is not the cheapest application available due to the additional payment processing fees, the application is worth checking out for those who need an easy way to manage their business expenses, as it is one of the best invoicing tools in the business.

Pros

- Stores client information

- Tracks billable hours

- Scan and record expenses

Cons

- Some customers report syncing issues

- Additional charges for accepting payment

Pricing

- $3 to $39.99 per month

Free trial

- 30 days

6. Square

The most convenient way to automate invoicing

Square is considered by most companies to be one of the best invoicing tools. It is the small and medium-sized enterprise solution for fast and easy payment processing. Today, the name is synonymous with invoices, another quick and easy business process. Square invoicing allows you to send digital invoices (and quotes, by the way) in seconds.

Additionally, you can use the electronic control panel to track payments from any device. Square also allows businesses of all sizes to send reminders and accept online payments with convenient payment options such as Apple Pay and Google Pay. This gives your business an edge over other small and medium-sized enterprises.

If you have regular customers, Square lets you save your business cards for automatic debit. Going one step further, Square enables you to manage your cash flow intelligently, including robust reports and progress invoices.

From customer service to retail, freelancers, and more, SMEs everywhere are gaining with this invoice app that lets you send professional digital invoices, email or text receipts, track business performance, and receive payment immediately. All this with no monthly fees.

Pros

- Automate invoicing

- No monthly fees

- Track and accept online payments

Cons

- Fewer frills than competitors

- Can’t add new values to the invoice page

Pricing

- From 2.9% plus $0.30 per invoice paid

Free trial

- Always free

7. Invoiced

Speeding up your accounts receivable process

If you spend a lot of time and money managing customer payments, Invoiced has a lot to offer. With features like subscription fees, payment plans, and online billing, every business in any industry has clear benefits to get from Invoiced, giving it a spot on the list of the best invoicing tools available.

With a free 14-day trial and personal demo, you can use the platform to accept one-time payments or build long-term relationships with your regular customers. From your customers’ point of view, an easy-to-use customer portal can also be lovely and create a positive impression of your business.

Pros

- Free 14-day trial and specialized demo

- Intuitive, easy-to-use interface

- 360-degree customer portal

Cons

- Lack of phone support on the basic package

- No application

Pricing

- $100 per month – $500 per month

Free trial

- Yes

8. vCita

Invoicing made simple with an all-in-one platform

vCita, one of the best invoicing tools, brings all your invoicing needs together in one neat and tidy package. Everything from start to finish can be done with a single billing application. Start sending a quote to potential customers before the job starts. Once set up, you can post invoices and even accept payments through the online platform.

With vCita invoice software, you can closely monitor customers and their payment history, send late payment reminders and customize invoice templates for more branded messages.

vCita also comes with scheduling software, marketing tools, and a complete CRM system to track your customers on an organized system. Speaking of regulations, the vCita invoice application works directly with accounting software such as Zapier and QuickBooks for hassle-free books.

Pros

- Accept online payments with credit card or PayPal

- Send quotes, invoices, and receipts from the same platform

- Track payment history and send reminders

Cons

- It doesn’t support multi-currencies

- Short free trial

Pricing

- From $19-$239 per month

Free trial

- 14 days

9. ZarMoney

Feature-rich invoices and accounting for small and medium-sized enterprises

ZarMoney is a feature-rich accounting and billing suite, especially suitable for entrepreneurs and small businesses. It’s fun to use because of its customization, fast and understandable reporting, and careful workflows. I hope to see more integrations and additions in the future, especially in the area of payments, but all the major platforms like Stripe, Shopify, and PayPal are there.

ZarMoney pricing is competitive, starting at $5 per month for entrepreneurs and $7 per user per month for small and medium-sized businesses, and should easily fit into any budget. At the time of writing, ZarMoney does not support recurring billing yet, although this feature is scheduled for release in an upcoming version.

Otherwise, the software is very powerful. Support is available via email or phone during business hours (PT), but a knowledge base with helpful videos will answer most questions. Overall, ZarMoney is robust, well-designed, and one of the best invoicing tools in the industry.

Pros

- It is cloud-based

- Intuitive workflow

- Helpful knowledge base

Cons

- No dedicated mobile app

- Limited integrations

Pricing

- $5 – $12 per user per month

Free trial

- 15 days

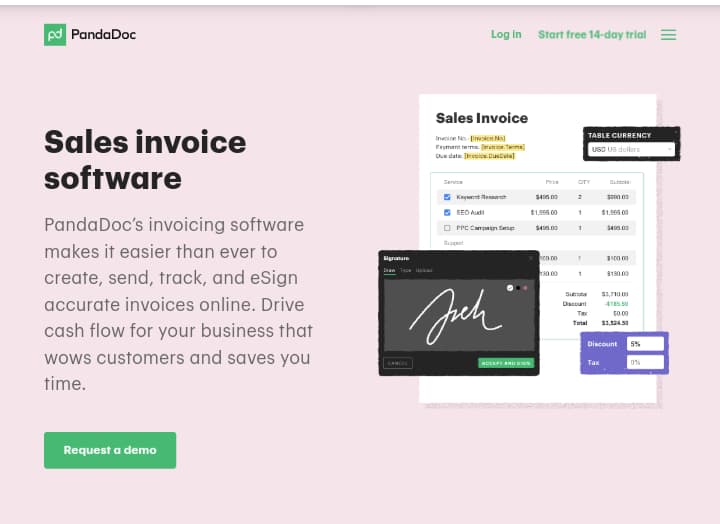

10. PandaDoc

Seamless invoicing with built-in eSignature

PandaDoc is a cloud-based business solution that automates each step of the sales process, from bids to offers, contracts, digital signatures, and payments.

The free service allows you to collect digital signatures and payments with an unlimited number of documents. Its different subscription plans include features such as custom branded documents and real-time tracking that alert you whenever a potential customer interacts with your sales document.

Document customization is one of the most essential features of PandaDoc, with over 450 templates, as well as a drag-and-drop processor for embedding media and Canva integration.

In general, the main reason for using PandaDoc is that it reduces the friction associated with the sales process, allowing potential customers to pay by credit or debit card directly from the document. That’s why I put it on the list of the best invoicing tools available on the market.

Pros

- Unlimited document uploads and eSignatures

- Easy to brand documents with Canva integration

- Customer engagement tracking and alerts

Cons

- Lack of added value outside of the sales process

- It doesn’t integrate with all accounting software

Pricing

- Free (eSign)

- $49 per user per month (Business)

Free trial

- 14 days

Frequently Asked Questions

1. Why do I need online invoicing software?

The best invoicing tools have revolutionized the way companies bill and are paid for services. At the basic level, the invoice application works as follows:

- It makes a list of the services or products you offer.

- It then creates a list of the prices and costs you charge for these services and synchronizes them.

- Then, when you provide services or products to a customer, the system automatically generates an invoice based on the products and price lists.

- The invoice software will generate invoices online so you can decide how to send them out.

The fact that everything is done online means that you can access your invoices online, from anywhere, from any device.

This allows you to charge your customers at any time by simply clicking or pressing a few buttons. It also means you have access to pending invoices whenever you need them. With a cloud-based system, you can create online invoices and customize them for your business.

These are some of the advantages you can get from the best invoicing tools out there:

Saves time: Creating, importing, and sending invoices for each project and client can be an arduous task. The best invoicing tools mitigate this problematic task by automating most of this process. Billing software automatically generates invoices based on predefined parameters.

You can add expenses, scan receipts, and include other details for specific customers (such as taxes and discounts). All of these details can be time-consuming if done manually. However, with the best invoicing tools in place, the job takes very little time.

Besides, the free invoicing software will automatically provide you with invoices. So you can automatically send invoices for recurring projects, send late payment reminders, and send bulk invoices to multiple customers with the exact details. All these functions are designed to save you a lot of time, and they do it!

Reduces errors: Human error has cost companies millions of dollars. As a result, many companies are switching to digital. In addition to convenience, even the free billing application gives you the peace of mind that the program knows how to seamlessly import information from accounting software, time tracking applications, and billing sections.

Saves money: But the best part is that the best invoicing tools can save you money. Obviously, you will save money on stamps, envelopes, etc., even the hours your employees need to charge customers they have recently served. But that is not what I mean.

Other significant advantages are:

- Easy follow-up for unpaid invoices

- Improved cash flow for business finance health

- Improved accuracy

- Easy auditing

2. What is the best software for invoicing?

At the end of the day, the best billing software is one that allows you to get the job done quickly and efficiently. What is “best” for your business may not be “better” for someone else. Therefore, you really need to know what you want from the invoice application and then look for a brand with these features. Some important things to look for include:

Templates: This allows you to quickly create an invoice without having to design the invoice from scratch. You should also make sure the template is customizable and so that you give it your own stamp.

Reminders: Reminders help you track your customers without having to pick up the phone (or lift your finger) in person. Automatic reminders can be sent when the billing date is approaching. Configure the auto-reminder always to remind your client when specified dates have elapsed.

Integrations: The best invoicing tools integrate with a variety of other business management applications for seamless synchronization. This eliminates errors due to misunderstandings or typographical errors. The integration will also make life easier for those who handle accounts.

For instance, an excellent invoicing software will work well with your time tracking tools. Therefore, you can charge the customer according to the time devoted to the project. The invoice application can be synchronized with a variety of applications, especially accounting, scheduling and receipt management applications.

Recurring invoices: The best invoicing tools also have the ability to create a template or save an invoice for future use. Therefore, if you have a customer who regularly buys the same items or a project that frequently uses the same invoice, you can quickly use the same template and send it out. You can also schedule recurring invoices to automatically send monthly, annual, or other regularly scheduled services.

Other convenient features you might want to consider include online payment integration (and buttons for paying immediately), the ability to store credit cards on files, creating and converting estimates, time tracking software, expense tracking, and a mobile-friendly web application for instant invoicing.

3. What is the difference between invoicing and billing?

All invoices are bills, but not all bills are invoices. That makes everything clear, right? If you need more details: bills are a more general term for any type of document that describes the payments made by a business or service. Invoices, on the other hand, are more specific business and legal documents with attached requirements.

The invoice must include a unique invoice number, date of issue, expiration date, official business name, and information and analysis of the goods or services offered.

Invoices are also generally issued for a project or product delivered on credit, while a bill is usually presented at the time of service or purchase. An invoice is a more complex and complicated document, which is why it is so vital for companies to understand it correctly. This is where the best invoicing tools come in.

4. What is the best free invoice software?

Free invoicing apps are similar to paid versions but usually have fewer features. You may have restrictions on the number of invoices you can send per month or the number of users that can use the application. Of course, the best free invoice applications still have many features and functions.

So you can have a lot of use from them. If you are a very small business (for example, 1-5 employees), a free invoicing application can offer you everything you need without paying a massive price for the functionality of big enterprises.

What is the best free invoice app? There are many great options to try, such as the Xero and Square. Just check the conditions to make sure you are not surprised by any subtle conditions.

Conclusion

Invoicing apps are the best choice for modern businesses. If you are unsure which one is right for you, check out different free trials until you find the one that works best for your business.

This way, you can experiment with other features, create free invoices online and familiarize yourself with the platform before you start paying. Isn’t it time you got paid faster for a job that was done well? Take a look at the best small business billing tools and find the best invoicing tools for streamlining your business payments today.