Introduction

Most small start-ups use worksheets and tables in running their workbooks, and some keep the practice as it expands. Apart from wasting time, it has the issue of having many varieties of documents with confusing and irrelevant figures. What is now the solution? I’ll recommend that you use the best small business accounting software.

The best small business accounting software helps you organize your entire business, from creating tax-required reports to maintaining your project budget. I tested few of the big names in small business accounting software to assist you in reviewing prices and quality and choose the right software for your company.

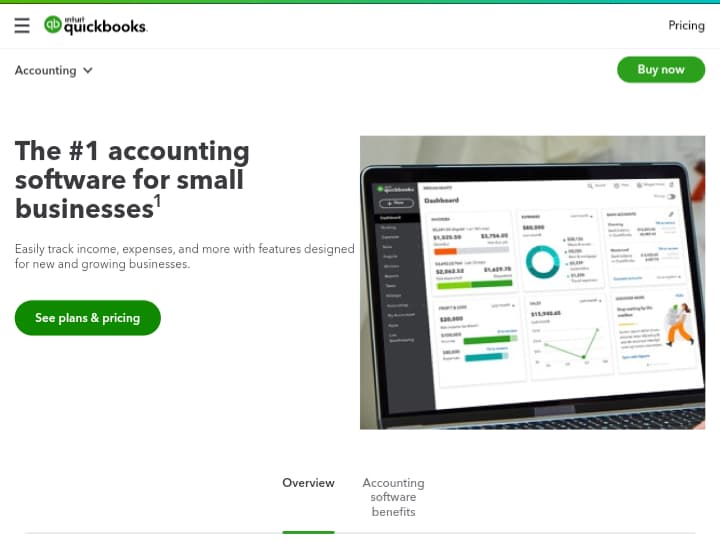

1. Quickbooks

Intelligent OCR-backed receipt processing

Quickbooks, one of the best small business accounting firms, is an all-round accounting system specifically built for small enterprises all the way to corporate firms with advanced levels of preparation.

This tool includes keeping track of expense receipts, which is OCR-backed, billing, and in the case of additional features, clients have the ability to put payroll features. It doesn’t make every feature present in the mobile app, however users may also use them alongside hardware for payment processing.

Pros

- It has Android and iOS apps for iOS

- You can track how profitable your project is

- Using the integrations, you can easily charge your clients by the hour

Cons

- There’s no free plan

- Every feature isn’t present in the mobile apps

Pricing

- From $12.50 monthly

Free trial

- 30-day trial

2. KPMG Spark

A human bookkeeper is included

You are looking for an electronic bookkeeping software, however, accountants can also be a convenience. Using this tool, you do not have to linger long in this tough decision.

One of the best small business accounting software, this accounting software that works in the cloud, is supported by a standby team and is built into into over 12,000 finance agencies.

Pros

- There’s a standby accountant

- It integrates with over 12,000 finance agencies

- A software that works in the cloud

Cons

- The technical support is small

- It doesn’t have a free trial period

Pricing

- From $195 monthly

Free trial

- Free demo

3. Freshbooks

Easily fillable document editing

If you are a company in search of a fast yet simple means of charging your customers, Freshbooks may be the easy option you are searching for.

It’s really simple to create invoices and expenditure using this tool. All you have to do is choose and input data in a downloadable document. You can also increase the system to include over 500 customers, making it one of the best small business accounting software out there.

Pros

- You can expand it to charge over 500 customers

- Edit your data by clicking

- Integration of payroll

Cons

- The payroll feature isn’t integrated into the software

- You can only track mobile mileage when you are using the paid plans

Pricing

- From $13.50 monthly

Free trial

- Free 30-day trial

4. FinancePal

Small and medium-sized business accounting and compliance made simple

FinancePal is one of the best small business accounting software with all the checkboxes selected. From accounting to bookkeeping to tax compliance to digital payroll featured, this company does it all. And because all functions work online, the whole process is seamless and easy and is an alternative to worrying about huge complex tax laws, accounting figures, and requirements for compliance.

FinancePal, being a unique business accounting software, gives every company its own team of accountants who are experts working in the tax compliance, corporate finance, and accounting sectors. Therefore, you can be sure that your company always meets the financial requirements.

Pros

- A personal team of accountants

- You can choose your plan

- A simple control panel with many functionalities

Cons

- You can’t compare prices

- There are third parties

Pricing

- Contact the company

Free trial

- Free trial

5. ZarMoney

Comprehensive business management and accounting

ZarMoney has many more features than regular accounting software and covers all aspects of business management, from managing your goods to invoices and teamwork tools.

In every field it offers solutions, ZarMoney really does it all. Inventory management includes managing multiple warehouses, customizing product fields, monitoring items using accurate information, segregating transactions, using FIFO pricing analysis, covering units of measurement, comparing inventory received with purchase orders, and transferring between sites, plus many others.

And it applies to all areas. The collaboration includes instant messaging applications, customizable calendars, notifications, note attachments, file attachments, and access permissions.

Billing and invoicing include initial payments, payment approvals, related transactions, email purchase orders, and more. I can stay here, mentioning all the functionalities that ZarMoney offers. But the best thing you can do is try a free trial and find out why it is one of the best small business accounting software.

Pros

- Lots of tools and features

- Its plans are affordable

Cons

- Nighttime logins can be affected by regular maintenance

- The many features means there’s a lot of things to know

- Poor graphic quality

Pricing

- From $5-$350 per month

Free trial

- Free trial

6. Wave Accounting

Free and easy-to-use accounting software

This company provides a free and user-friendly accounting system for small businesses and entrepreneurs. There are some problems: its mobile application can be worked on, there are not many ways to integrate it, and it is not enough for managing complicated inventory.

However, its accounting capabilities are so powerful that it is effortless to create and use, making it one of the best small business accounting software in the industry.

There is plenty to love, along with instruction guides, intuitive dashboards, and unbeatable prices. Small businesses and entrepreneurs that want to better manage their bills, payments, including expenditure will find what they need.

It’s free, so you won’t miss a thing if you try it. And it may turn out to be a more user-friendly option than what you’re currently using or a good starting point if you haven’t used it yet.

Pros

- It’s completely free

- Built for small and medium-sized enterprises

- You can track an endless number of income and expenditure

Cons

- Not all functions are available

- There can be more integrations

Pricing

- $0 – $35

Free trial

- Free software

7. GoDaddy Online Bookkeeping

Intuitive, beginner-friendly, and affordable

This software is undoubtedly not the most robust accounting software I have tested, but it performs all its promised functions. Highly user-friendly, quick installation, and is built for those who do not have any accounting knowledge.

It does not have special features, such as inventory control or support for various currencies, but I do like the tools provided. The billing and management of expenditure are simple and clear, and the integration of e-commerce and banking supports the fast-tracking of transactions. Overall, as one of the best small business accounting software, it is perfect if you are in need of a simple and inexpensive accounting program for the basic tasks.

Pros

- The pricing plan is affordable

- Seamless and simple integrations with multiple online stores

- Simple control panel

Cons

- Basic tools for time tracking

- Does not support different currencies

Pricing

- $4.99 to $14.99 per month

Free trial

- No

8. Paychex

Payroll tools and resources for accounting firms

Paychex is a popular human resource and payroll software, however, lots of accountants might not be aware that it is one of the best small business accounting software. It equally provides a set of features and resources aimed at assisting accounting firms in advising their clients in the common areas of human resources, accounting, and payroll.

Its AccountantHQ control panel gives accountants an insight of the status of their clients’ human resources and the situation of their payroll, access to crucial real-time information, features, and data to review them all and find opportunities. Its paid human resources subscription support services include 24-hour entry to a dedicated team, where the CPE webinars, courses, and other information are free to use.

Pros

- A lot of free tools for accountants

- Round-the-clock payroll and HR management service

- Robust AccountantHQ control panel

Cons

- Your pricing depends on how you use the software

- Pricing information is vague

Pricing

- Contact vendor

Free trial

- Yes (dashboard and resources)

9. Sage

Feature-rich, extensible, and straight-forward

Sage cloud applications are functional and practical in appearance, but they are well designed and relatively easy to use. Its extensive range of functionality means that there is a lot to know and the installation procedure was somewhat lengthy, but the software is perfect. That’s why I added it to the list of the best small business accounting software.

I recommend that you use the complete $25/month pricing plan, since its $10/month package does not have some significant features, but it still has reasonable prices, given what it offers. While Sage provides a lot of features, especially when it comes to stocks, charging and invoicing are just as powerful, with intelligent features like an online Pay Now tool. That’s why it’s one of the top accounting software options—it’s functional, scalable, and accessible.

Pros

- There are many integrations

- Simple and robust control panel

- Superb tool for managing inventory

Cons

- Extra cost for some features

- It is not easy to learn how to use

Pricing

- $10 to $25/month

Free trial

- Free trial

10. Netsuite by Oracle

Powerful, customizable, extensible ERM

NetSuite has a steep learning curve, but it is unmatched when it comes to power and customization. Also, its customer support for subscribers on the basic plan is very limited. This is another cause for small businesses putting a lot of effort into the experience.

However, this suite is large to the point of replacing a host of other functional and logistics applications (such as CRM and human resources), ultimately reducing overall costs, both labor and costs.

NetSuite is a fantastic option for businesses and multinational corporations that have to take care of complex operations with lots of mobile parts and possess the human and financial capabilities to make use of NetSuite’s robust platform to design the right ERM system; thus, it’s one of the best small business accounting software.

Pros

- You can customize it to your taste

- Robust forecasting, budgeting, and reporting

- Round-the-clock solution (project management, human resources, stock control, and more)

Cons

- Complicated installation process

- Very expensive

Pricing

- $999+

Free trial

- No (demos available)

Frequently Asked Questions

1. Accounting software: what is it?

Accounting software makes bookkeeping and accounting operations such as invoicing, payable accounts, receivable accounts, revenue, and expenditure automatic.

The best small business accounting software combines all information about your finances in one location, making it easy to exchange data between staff or with other, eliminating the need for dual-entry accounting or manual input by employees.

The best small business accounting software is available in two formats: online accounting software or desktop accounting software. Desktop accounting software means an app that is installed on your business computer. Online accounting software, known also as SaaS or software-as-a-service, offers similar functionality but works in the cloud.

2. What are the features you should expect in the best small business accounting software?

At the very least, the best small business accounting software represents an online accounting software that performs the basic accounting procedures described above, including invoicing, payable accounts, receivable accounts, revenue, and expenditure. However, that is not all. Here are few of the higher features added in the best small business accounting software.

Tax integration: The accounting software should offer profit and loss reports, balance sheets, plus other custom reports required by you and your bookkeeper for tax compliance. The best small business accounting software allows you to take photos and store receipts with a mobile phone for secure storage during the tax period.

Payroll management: This feature is generally not integrated into most accounting software, however, it is provided through third-party human resource integration and payroll software. Once all settings are complete, the software should calculate and submit payroll, settle payroll taxes, make direct deposit payments on the same day and take care of employee benefits.

Business insights: The top accounting software collects lots of information concerning your business, therefore, why shouldn’t you take advantage of that information? The best small business accounting software provides businesses with information and analysis using easy-to-use reports and control panels.

Customized receipts and invoices: You should note that any communication with clients and software providers is a chance to make your company better. Many accounting software allows you to design customized receipts and invoices, which can help you to promote your company.

Access to different users: Depending on your business’s size, I recommend that you allow multiple people to access the software. The best small business accounting software offers multi-user programs, including accountant access.

Mobile support: You don’t know where or when you need to record or get data using your mobile phone. A lot of the best small business accounting software offers free applications for Android and iOS.

Unlimited storage space on the cloud: A major advantage of employing digital accounting software is because you store every single information online, which has an almost unlimited capacity.

Free Support: When you have problems, you would like to know that the software provider is there for you. Paid subscriptions typically have an exclusive group of accounts.

Expandable: Accounting software is ideal for fast-growing businesses that find that manual imports can no longer work for them. There’s no obstacle for your company. Therefore you require an accounting software that provides small and medium-sized enterprise accounting options that can be tailored to your needs.

Ease of use: The final one is ease of use. Your bookkeeping and billing software must be simple for all team members to learn to use in a matter of hours.

3. What’s the cost of accounting software?

With the majority of online accounting software, the price is dependent on the number of features required and the number of users who need access. As for accounting software, pricing models may be different. Some companies will charge a flat monthly fee that includes a major part of the functions, where others have gradually increasing rates as you include more features.

Based on my research on the top companies, accounting software can cost from $12 to $300 monthly. Cheaper subscriptions automate essential accounting features such as revenue and expense tracking, invoicing and receiving payments, cash flow management, keeping track of sales and monitoring of sales tax, and giving estimates.

There is an additional cost to integrating payroll. It is part of a more expensive plan or costs between $4 and $10 for each employee each month as an extra feature. More features, such as income tax preparation, are likely to come at an additional cost.

4. Which is the top free bookkeeping software?

Without any doubt, there is free accounting software available. I do not mean Google Sheets and Excel. The top companies in free bookkeeping software are ZipBooks, Wave, and SlickPie. These are all online accounting service that provide essential functions such as accounts receivable, expense tracking, and revenue and creation of balance sheets.

Free bookkeeping software is a great starting point for individuals and small businesses who want to update their spreadsheet programs such as Google Sheets and Excel. Basically, they allow you to perform every function that these tools could possibly handle if there was time for you to input all the details yourself.

Although free software are helpful for the basics, it provides nothing like the functionality provided by paid accounting software. If you need software that can perform functions such as payroll management, inventory tracking, and tax filing, you will have to subscribe to a paid plan.

Conclusion

If it’s possible to automate your business management tasks, you may need it. Doing manual bookkeeping can be less expensive right now, but you will soon run the chances of making mistakes that can be time-consuming and costly to grow your business.

The best small business accounting software is built to expand with you, therefore you can begin by simply automating basic accounting functions and adding more complicated tasks such as payroll and reporting of tax as time goes by. When you start using the best small business accounting software, you’ll wonder why you wasted such amount of time.