It is commonly said that where you study will be one of the most important decisions you make in your life. However, this does not tell the whole story. Another equally important decision that most people must make before they go to school is how they can fund their education. And if you can’t get a federal loan, you might want to consider the best private student loans

This is a decision that shouldn’t be joked with. Yes, tuition fees can be worrisome, but if you choose the correct lender, it becomes less of a burden.

This article gives you a list of top 10 private student loan providers. They all offer the best private student loan rates in the business. But I didn’t select them just based on that, I selected them for other factors such as their experience in handling student borrowers, their flexible repayment plans, and other benefits like free mentoring and scholarship programs.

You may notice that in this guide, there’s not much information about cosigner options. This is because all 10 companies in this list have a cosigner option by default. Additionally, only one company here does not offer a choice between fixed and variable rates.

It’s a general rule that if you want the best rates, you should have excellent credit (or bring a cosigner with excellent credit), then you can select a variable rate and decide to use autopay in making monthly payments.

1. College Ave

Get a decision within three minutes of applying

College Ave is top on this list of student loan providers for several reasons.

The first one is because it is only dedicated to student loans (as you can see from the name). Another reason is that its strong Fintech platform will give you an answer in a few minutes.

Thirdly, College Ave offers you maximum flexibility, including some types of loans you can’t see anywhere else (like the parent, career training) and 4 repayment terms—5, 8, 10, or 15 years.

If you go to the website of College Ave, you’ll readily notice how transparent it is. You’ll see how rates and other relevant information are clearly shown on the homepage. It also displays a lot of other enticing offers too like scholarship opportunities and a guaranteed cashback of $150 when you finish your degree.

Pros

- It offers a host of competitive and transparent rates

- There is the option of parent loans

- It gives you a cashback when you finish your degree

Cons

- It offers repayment terms that are limited to 15 years or less

- It lacks a proper forbearance policy

2. Ascent

Best choice for poor credit

This student loan provider is an excellent choice for those with bad credit. It has a minimum credit score which is 40 points lower than the other companies in this list. It gives more flexibility but offers much higher rates too.

The lowest APR of Ascent is higher than the other providers on this list. This makes a lot of sense because this company does not target borrowers with high credit.

Also, this company dedicates a lot of time to running promotions than other student lenders. It equally offers a 1% cashback when you graduate, offers a $525 refer-a-friend cashback per referral. Ascent also offers regular scholarship giveaways.

Pros

- It offers a 1% cashback upon successful graduation

- There are regular scholarship giveaways

- It has a refer-a-friend program

Cons

- It does not have the best APRs in the market

- Its loan amounts are limited

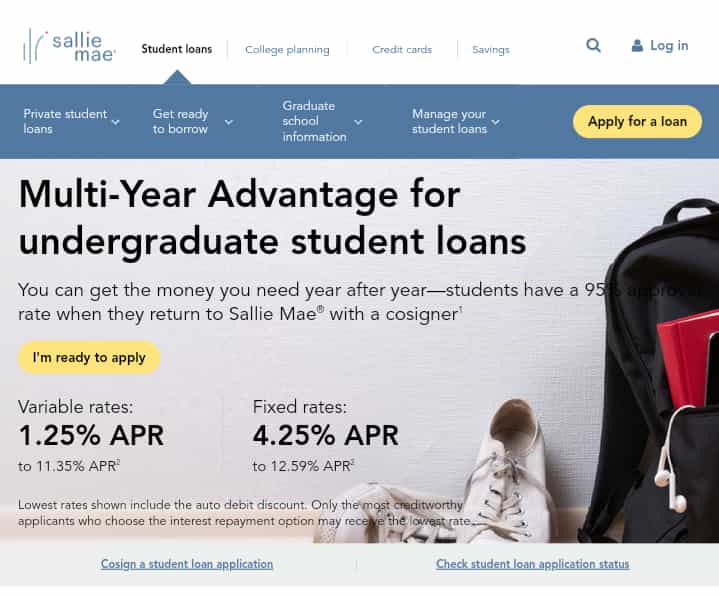

3. Sallie Mae

Biggest range of loan options

Sallie Mae, which was founded in 1972 is one of the oldest and most popular private student loan providers. Also, it caters to more borrowers than any other student loan companies.

Sallie Mae offers a wider range of loan types—undergrad, graduate, parent, career training, and even K-12—than any other lender. It even offers loans to other sets of people which other companies tend to ignore such as non-Americans and part-time students.

Sallie Mae is a lot more flexible than most student loan providers. Its website or filled with lots of information on the various loan repayment options like deferment and grace periods and what it all means for your principal and interest.

You can also come with your cosigner and they can be released within only 12 months into your loan.

Pros

- It provides loans to part-time students

- Non-American students can apply with American co-signer

- It offers a free Chegg study help (valued at $100)

Cons

- The minimum credit score is not disclosed on the website

- There is no information about income requirements

4. SoFi

Simple online application

This company is one of the top companies in fintech. It has a very simple lending process for student loans, mortgages, personal loans, and others. And typical of all SoFi products, its loans come with transparent terms and repayment options.

It also offers lots of free tools and resources which will help you make the most of your college experience.

All SoFi customers immediately get access to Edmit Plus when they sign up. Edmit Plus is a financial tool that helps you estimate financial help, compare the cost of attendance, or learn more about scholarships and merit aid.

It also offers you personalized salary estimations according to your profile and course. This is to ensure that you make the best possible choices.

Pros

- You can get access to network events and work opportunities

- It offers you discounts on college entrance test prep

- There are free financial planning tools available

Cons

- It has a high minimum borrowing amount

- It generally doesn’t offer loans to community colleges

5. Earnest

Excellent rates for people with good credit

This is a Fintech company that offers both private student loans and student loan refinancing. It has an easy-to-use website, and you can fill out an application in less than 3 minutes. It has a super-fast algorithm that gives you a decision within seconds after you submitted your application.

Although it has stringent requirements before you’re eligible for a loan, if you qualify, the conditions are great. It has just about the lowest rates for borrowers/cosigners with excellent credit.

And if you’re approved, Earnest offers a lot of flexibility such as a longer grace period than almost all the other companies. It also offers the option of skipping 1 payment each year.

Pros

- It offers you a 9-month grace period

- You can skip 1 payment each year

- There are no fees at all

Cons

- Earnest only serves degrees at Title IV-qualified schools

- It has stringent qualifying requirements

6. LendKey

Best loans from over 300 credit unions

This is an online platform for private student loans from credit unions and community banks. This marketplace operates like any other marketplace, pre-qualifying you for different loan providers and helping in comparing your different options.

The major difference between LendKey and another marketplace in this guide (ie Credible) is that LendKey does not work with private loan providers.

The application process for LendKey is as simple and fast as you could hope for. You can fill out an application within a few minutes and get your personalized results. The LendKey’s software takes serious note of your profile.

For instance, if you worked in teaching, you’ll be taken to a teacher-related credit union, and if you worked in the military, you’ll be directed to a military-related union.

Pros

- It offers pre-qualification for multiple lenders with 1 application

- You have multiple lenders compete for your attention by cutting rates

- It has a very quick application process

Cons

- All the loans require credit union membership

- They require your contact details required to see before you can see rates

7. MEFA

Nonprofit with fair rates

MEFA is an acronym for the Massachusetts Educational Financing Authority. It’s a non-profit organization that provides competitive loan rates to students who are registered at various qualifying Massachusetts institutions.

Although this organization only works in the state of Massachusetts, I added it to this list because it’s a good example of a non-profit organization that goes the extra step in helping students.

MEFA goes beyond most student lenders. Although it has a high minimum credit requirement, it offers very competitive rates in general. MEFA also offers very flexible repayment terms, in addition to deferred payments and a good interest-only grace period.

On the website, there are tons of educational materials that will help you in making the right decision.

Pros

- It offers very competitive fixed rates

- Its website has a lot of educational resources

- It offers maximum flexibility for existing borrowers

Cons

- It exists only for Massachusetts students

- It has no variable rate option

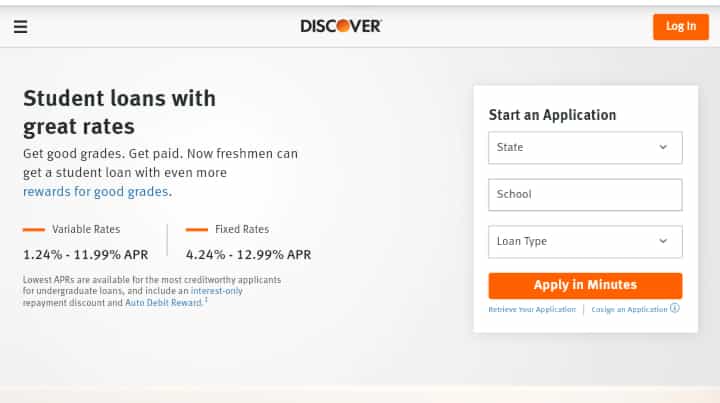

8. Discover

A trusted name in finance giving student loans

Does the name of this company sound familiar? That’s because more than 50 million Americans use its credit cards. Discover started giving loans to students in 2010 when it acquired the Student Loan Corporation from Citigroup.

Now it is one of the top companies that give loans to students in the US. It offers undergraduate loans and also lots of graduate loans (MBA, law, bar exam, medical residency, and health professions).

Yes, Discover does not have flexible payment options (only 15 years) but it makes that up in the plethora of incentives it offers which would be hard to get anywhere else. Take for example, when you qualify for a loan, automatically you pre-qualify for the rest of the years in your degree.

It also promises a 1% cashback on your loan amount if you graduate with a 3.0 GPA and above or its equivalent.

Pros

- International students can be accepted with an American cosigner

- You get an automatic pre-qualification for future years

- You will receive cash rewards for good grades

Cons

- There are limited repayment options

- It has a high credit score threshold

9. Credible

You can compare the top lenders in one place

As an online marketplace for loans, Credible helps borrowers get private loans from its network of trusted lenders. Some of its partners include Sallie Mae and College Ave. The advantage of applying for loans through Credible is that you are saved the time of applying separately to multiple lenders.

Credible works with its customers throughout the whole loan process, unlike other marketplaces. Its San Francisco-based customer support representatives are there for you 7 days a week. They can provide a 3-way phone support linking you with the top lenders.

Pros

- It saves you the time of filing multiple applications

- It has customer support for 7 days a week

- It’s good for financing for almost any degree

Cons

- It’s not a direct lender

- It is limited to undergrad and graduate degrees

10. CommonBond

More than a lender, a mentor too

This lender with a difference CommonBond was founded in 2012. It aims to build a strong relationship with its customers and doesn’t necessarily see them as only borrowers. This attitude is evident in its free program called Money Mentor. This program delegates an advisor to you who helps you manage your budget and get internship opportunities.

Do you want a loan that also comes with social responsibility? Then you should go to CommonBond. It partners with Pencils of Promise to provide schools, teachers, and educational materials to thousands of Ghanaian students.

When a new borrower takes a loan (or refinances a loan), CommonBond covers the cost of one child’s education in Ghana.

Pros

- It offers a 12-month forbearance period

- There is a 6-month grace period for its customers

- It donates to children’s education in the developing world

Cons

- It charges high fixed interest rates

- It is not available in Nevada or Mississippi

Frequently Asked Questions

1. What are Private Student Loans?

Private student loans are a lot like federal loans because you can use them to finance your school expenses. When you take out a student loan, you become responsible for repaying the amount you borrowed after your period of grace has expired (usually 6 months after graduation or dropping out of school).

However, unlike a federal loan, a private student loan is not backed by the government. This type of loan is rather backed by a bank, credit union, or an online lender. Generally, federal loans have better loan terms, repayment plans, and have no requirement for a credit check. But you have a limited amount of money you can borrow to finance your degree.

If your federal loan isn’t enough to cater to your education, then you need private loans to fill in the gap.

It’s much easier for students to get financial aid and federal loans for their undergraduate programs, but receiving those aids for financing their advanced degrees becomes tougher. That’s where private student loans are really important. They’re the additional financing you need to finish your undergraduate degree and go for advanced ones.

2. Things to Consider When Looking for a Private Student Loan?

As you think about getting a private student loan, you’ll want to consider a lot of the same factors you would when searching for a personal loan.

You should ascertain if the loan comes with a fixed or variable interest rate. Also, check if it’s easier for you to take a longer loan term with higher interest rates or a shorter one with lower interest but has higher monthly payments.

Private student loans are a lot more lenient than federal loans. However, you might not be allowed to postpone your repayment until after your graduation, or you might not be given the chance to pause your repayment schedule if you become unemployed.

You should look at your monthly income and know how much to bring out each month for paying off the loan, and if you’re at risk of defaulting. Also, consider if it is more sensible to take out a loan that requires interest-only payments while in school if you’d rather make your monthly payment in full if they can wait till you graduate.

Be sure to know the type of fees the loan provider charges for the loan and the type of customer service options they provide.

3. How Do You Apply for a Private Student Loan?

The first thing you should do before you apply for any loans is to check your credit score and know how good or bad it is. Private student loans usually require a higher credit score, so if you have a lower credit score, you may have to find a cosigner.

Also, you should get a cosigner if your credit history is messy. Typically you should look for someone in your family with a good credit score to be your cosigner when applying for the loan.

You also need to get some necessary documents ready for the application. Documents like:

- Your Social Security number

- Your date of birth, address and identifying details.

- Pay stubs

- Proof of assets

- Monthly rent or mortgage receipts. Any other information that lays out your financial status

You also have to fill the Private Education Loan Application Self-Certification form. This form is provided by your school and will tell the lender the exact costs you face for your education.

Also, try to figure out how much you want to borrow. Do you want just enough to pay for your tuition or do you want to include your living expenses too? This will go a long way in determining the size of the loan.

Then finally you should fill out a formal private student loan application with the lender you choose.

Summary

It’s common for people to go into debt when going to college or grad school. Although you may not be able to prevent yourself from borrowing funds, you can avoid making the wrong choices.

Always make your research and compare different lenders before you apply for a private student loan with the lender that best meets your needs.